Britain’s Sugar Tax: Will it be a Sweet Deal?

The Scientific Advisory Committee on Nutrition (SACN) recently reviewed the evidence on the effects of carbohydrate consumption on health 1. In their report, they conclude that when people consume products high in sugar, they are likely to exceed their overall energy requirements, placing them at risk for weight gain. When it comes to high-sugar soft drinks in particular, the SACN concluded that drinking such sodas leads to weight gain and increased BMI amongst children and teenagers. Over-consumption of fizzy pop therefore increases the risk of developing obesity and type II diabetes.

In Britain, 20% of 4-5 year olds are considered obese, increasing to 30% among 11 year olds. In turn, obesity is known to contribute to a myriad of other diseases, such as heart disease and cancer. Excess sugar and soda consumption is also associated with tooth decay, the main cause of hospital admittance among children in the UK. This led the SACN to conclude that consumption of sweetened beverages should be minimised by all, and that the maximum intake of free sugars should not exceed 5% of our daily dietary intake. The latest National Diet and Nutrition Survey, however, shows that the average consumption of added sugars in the UK dramatically exceeds these recommendations in all age groups 2.

Children and teenagers get 11.9 to 15.6% of their daily food energy from added sugars, and sugary drinks are the main culprit. Britain’s teenagers may even get up to 30% of their total sugar intake from sodas. Clearly sugary drinks are bad for health, but they are also bad for the state budget: obesity is estimated to cost the UK £27 billion a year – almost a quarter of the NHS budget.

From a nutritional perspective, however, sodas do not serve any benefit. They contain a lot of calories, but no beneficial nutrients, and are especially dangerous to our energy balance for two reasons. First, because they are liquids, we can quickly ingest large volumes. Therefore, the rate of sugar intake is much higher for a can of Coke compared to munching away on the sugar equivalent in whole fruits. Secondly, sugary drinks contain free sugars that are quickly absorbed by our digestive system and therefore do not leave us feeling full for very long. In contrast, when eating whole fruits, we are ingesting the entire food matrix. This means you have to spend some time chewing, after which your digestive system has to do further work to break down the fruit and its fibres. The sugars therefore enter our bloodstream more slowly and our stomach is kept filled for longer, leaving us feeling satiated. For this reason, sodas are a perfect target for legislation: they are evidently harmful to our health, do not serve a nutritional benefit, and we have healthier alternatives available. Importantly, whereas other unhealthy food groups can be very diverse (e.g. snacks), sugary drinks can be clearly defined to be targeted by policy. The call for action by various health groups, campaigns, and specialist groups has been growing in the past few years. With the 2016 Budget, it seems the government has decided to act.

Starting in April 2018, industry will be taxed based on the volume of sugary drinks they produce or import: 18p per litre for drinks containing 5-8 grams of sugar per 100 millilitres, and 24p per litre for drinks with sugar content of over 8 grams/100ml. Scotland’s beloved Irn Bru, for example, would fall in the more expensive category with its 10.3 grams of sugar per 100ml 3. In contrast to other countries that have introduced sugar taxes, however, Britain’s tax is not a “consumer pays” sales tax that increases the price of sugary drinks in the shops. Rather, the sugar levy will be placed upon the manufacturer. By choosing to tax industry, Osborne has expressed the hope that industry will reduce sugar content of their drinks, or promote low- or no-sugar products. This does not mean, however, that customers will not see any price increases in the shops: companies are free to adjust the price of their products to make up for tax losses. Whether paid for by industry directly or through price increases by the customer, the sugar levy is expected to raise £520 million in its first year. The government aims to take additional steps to combat childhood obesity by using this revenue to increase funding for physical activity and sports in schools. As Osborne put it, the UK government is willing to put the next generation first in order to create “a Britain fit for the future” 4.

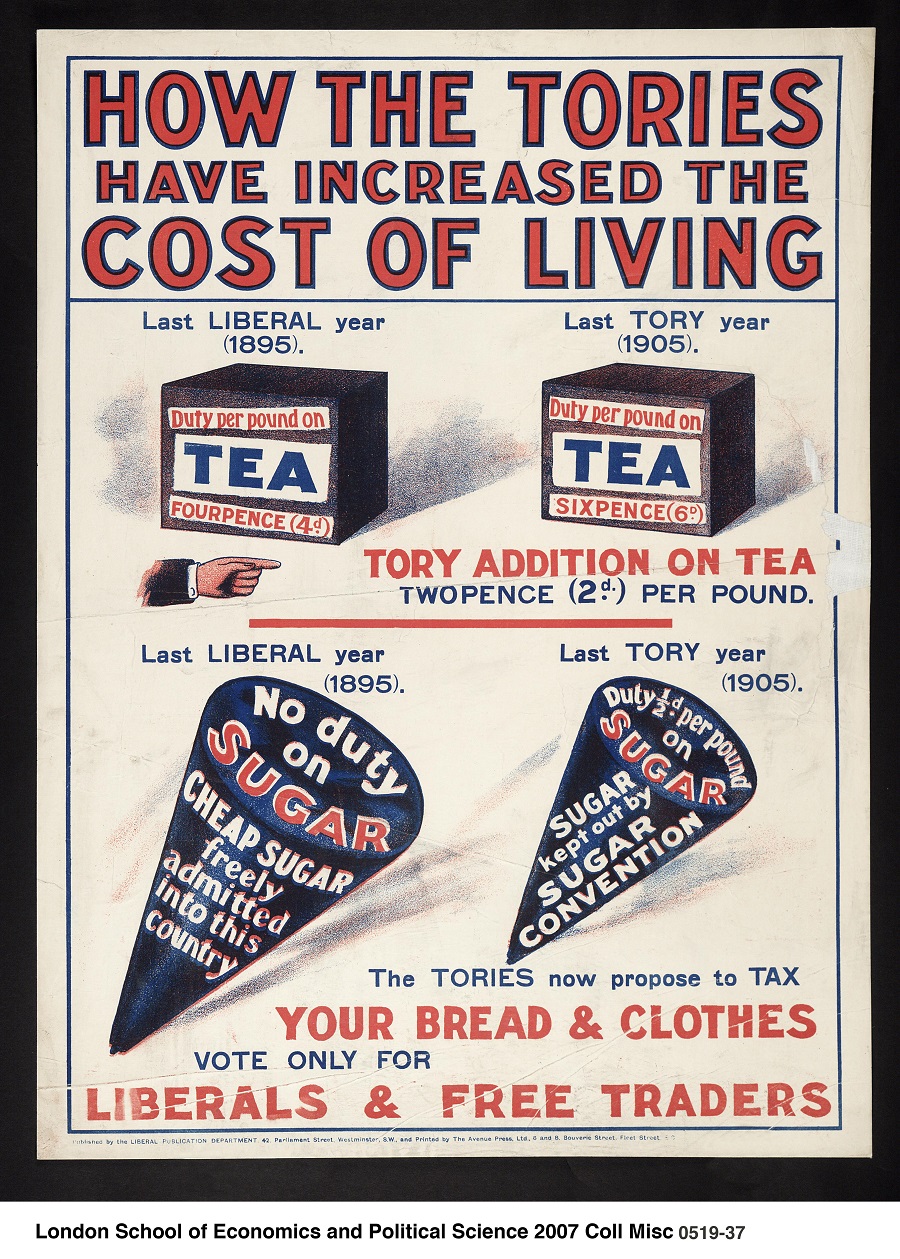

The idea of taxing ‘bad’ products is not new: the famous Scottish moral philosopher and political economist Adam Smith advised to tax sugar, rum, and tobacco in his 1776 book The Wealth of Nations 5. Though he reasoned from an economic perspective, taxing tobacco and alcohol to discourage their consumption is a widely accepted practice today. In contrast, not many countries have adopted a sugar tax, and whether the UK soda tax will be a good thing is the topic of fierce debate. Proponents have hailed the tax as a public health strategy that will reduce childhood obesity and associated diseases. However, this all hinges on the assumption that such a tax will actually cause a decrease in soft drink consumption.

So what does the science say? Unfortunately, there are a lot of conflicting studies claiming opposite effects. Critics note that many studies investigating the effects of food taxation are commissioned by the food industry or conducted by other interested parties, which makes it difficult to judge whether their findings are truly impartial. In turn, reports commissioned by health organisations reviewing the scientific evidence often cherry pick to include conclusions that support their case and leave out others that do not. Additionally, many studies are based on predictive mathematical models that try to integrate the expected effects of price changes on consumer purchasing and subsequent changes in consumption, which may finally translate into health benefits. Clearly, such models are based on several assumptions and may not take all real-world effects and compensations of such legislations into account.

Considering all these critiques, two research groups recently performed a systematic review of all the scientific evidence currently available and concluded that overall, taxation can improve dietary behaviours of the public 6. They conclude that a combination of taxation of unhealthy foods and subsidy policies to increase healthy food consumption seem to be most effective. Investing the tax revenues into strategies to further increase public health can maximise the effectiveness of tax policy. Additionally, they found that product price is the main determinant of purchase: consumption therefore reduces proportional to the tax applied. Overall, prices need to increase by over 10% in order to achieve dietary changes and subsequent health benefits. Finally, they conclude that fiscal policies are likely to be more efficient when they are combined with increased education and marketing of healthy eating patterns to prevent customers from switching to alternatives that are just as unhealthy.

So how does the UK soda tax score on these determinants of food tax success? Considering that product price seems a critical factor to influence consumption, it seems essential that industry passes the tax onto consumers via price increases. The government assumes that the tax will be fully passed onto customers in their Budget revenue calculations, but it is possible that industry will partly absorb the tax to maintain their current prices and sales, decreasing tax effectiveness. Using the revenue of the levy to invest into health promotion activities such as school sports seems to be a sound strategy of the government, as this combination of policies has been shown to be most effective in increasing the overall health of the population. One worry, however, is the possibility of substitution effects: studies show that customers may substitute taxed products by switching to cheaper brands or products that are not taxed, but are equally unhealthy.

In light of this, it is unfortunate that milk-based drinks and pure fruit juices are exempt from the levy. This product group includes a myriad of fruity drinks and smoothies specifically marketed to children that hint at having health benefits with claims of fruit, vitamin, or mineral content. Metabolically, however, they are similar to other sugary drinks: providing fast, easy-to-absorb calories in bulk. A recent investigation into fruit drinks and smoothies sold by the seven major UK supermarkets found that almost half of them contained the entire recommended daily intake of sugar for children in a single serving 7. It seems therefore essential that nutritional education and stimulation of healthier alternatives by the government and public health bodies accompany the tax to prevent customers from switching to equally sugary alternatives.

To conclude, it seems clear that Osborne’s soda tax alone will not solve the epidemic of childhood obesity in the UK, but it is a step in the right direction if the critical determinants of food tax success are taken into account. It remains to be seen whether industry will reduce the sugar content of their products and if they will pass the price increase onto their consumers, discouraging purchase and consumption. It will also be interesting to see whether the government will develop strategies to promote healthy alternatives parallel to the tax, and whether this will be able to prevent substitution behaviours. Among the international call for soda taxes, Britain’s new legislation will provide a much needed real life experiment on the effectiveness of such taxation. I will be following the development of the UK sugar tax with interest and am curious to see whether its health benefits will exceed that of the State Budget.

This article was specialist edited by Fiona MacFie and copy edited by Matthew Hayhow

References

- You can find their report here: https://www.gov.uk/government/publications/sacn-carbohydrates-and-health-report.

- View the full results of the survey here: https://www.gov.uk/government/statistics/national-diet-and-nutrition-survey-results-from-years-1-to-4-combined-of-the-rolling-programme-for-2008-and-2009-to-2011-and-2012

- Find out how your favourite fizzy drink scores on the sugar scale in this BBC quest to find Britain’s most sugary drink: http://www.bbc.co.uk/news/magazine-35831125

- You can view George Osborne’s full speech here: https://www.gov.uk/government/speeches/budget-2016-george-osbornes-speech

- Adam Smith was a pretty interesting fellow – you can read more about him on the website of University of Glasgow’s Business School, which was named after him: http://www.gla.ac.uk/schools/business/aboutus/adamsmith/#/adamsmithandtheuniversityofglasgow

- You can read the two studies here: http://www.sciencedirect.com/science/article/pii/S0899900714005486, http://nutritionreviews.oxfordjournals.org/content/72/9/551

- You can read the original research article here: http://bmjopen.bmj.com/content/6/3/e010330.full or The Guardian’s report about it: http://www.theguardian.com/society/2016/mar/23/fruit-juices-smoothies-contain-unacceptably-high-levels-sugar.