Part 4: The Current State of Bitcoin and its Future

This article is part of a GIST series on Bitcoin. In part 1, we described the mathematics that underpins digital currencies like Bitcoin as well as the security of the web itself. In part 2, we went into more detail as to how Bitcoin works. In part 3, we discussed how Bitcoin attempts to keep the production of new Bitcoins relatively stable. In the final part of our series, we will discuss how Bitcoin looks today, how people use it, and speculate as to what what the future holds for it.

If you’ve read the technical details outlined in the first three parts, you’ve now got the concept. What, however, is actually happening with regards to Bitcoin today? Since 2009, there have been over 12.5 Million coins mined, worth, at the peak price of $1,200 (USD) per bitcoin, about $15 Billion 1 (with caveats though — discussed later).

In the previous two articles, we discussed how mining rewards halve every 4 years. As of January 2014, the rate of production stands at a fairly steady 1.4 Million bitcoins per year 2, though the early production was double this figure due to the reward for mining also being double. With the halving of block mining rewards built into the protocol, the absolute maximum number of bitcoins that can possibly be available will be 20,999,999.9769, reached at or about the year 2140. That means that by the end of 2014, two thirds of the total possible bitcoins have been mined.

Aside: valuing bitcoins

There are problems associated with placing a value in a real-world currency on a bitcoin. Firstly, the coins are only worth what a buyer will pay for them, so the currency relies on continual purchases of coins and the continual use of bitcoins as payment for goods and services. The recent peak price of $1,200 per bitcoin was partly fuelled by political reasons, with the price rising from a reasonably stable $100-200 per bitcoin to this peak price in a little over a month. The explosive growth was then followed by a halving of value in only two weeks. The market is highly speculative, and for every big winner there is a big loser.

Additionally, sitting on a large stockpile of bitcoins does not necessarily mean you can then sell them for the market value. You must find a buyer willing to take them, and with the market in such an unstable state there is limited capital being made available for purchases. Part of the recent price hike has been driven by the demand for coins, and flooding the market with readily available coins could cause the price to drop. It doesn’t make sense to value bitcoins in dollars until after you’ve sold them for dollars.

However, there is a market for payments made with bitcoins. More and more stories are appearing of bricks-and-mortar shops and cafes starting to accept it as a form of payment, in addition to the host of online sites already accepting it. Governments are starting to get worried, some more than others. Recently Russia banned the use of Bitcoin altogether 3.

Wallets and wallet services

In reality, the ‘serial number’ given to bitcoins is actually just a hash produced from the transaction information. This serves as both a unique reference number for the currency and also a way of verifying the owner’s identity. The keys used by the public key encryption in Bitcoin are sixty-four characters long, and this contains enough entropy that there are trillions of possible unique combinations. As such, to enhance privacy it is practical for users to create a new unique public and private key for every transaction made with Bitcoin. Keeping track of the passwords used to generate the keys is difficult though, so most users make use of wallets. These can be programs running on the user’s own computer or websites offering online services. They can generate new Bitcoin keys with which to send and receive currency and can manage existing keys. Wallets will report your total number of bitcoins as the sum of the individual values corresponding to each key, and an easy to use wallet will abstract this information from the user.

Mining Pools

It is now no longer feasible for a home user to compete with others to mine a block; such has been the increase in computational power and so in turn the difficulty of mining blocks. Instead, users are clubbing together into ‘pools’, where each member works simultaneously to solve the same proof of work. Each user taking part in the pool then receives a share of the reward should someone in the pool successfully compute the proof of work.

Apart from the obvious advantages, taking part in pool mining can be dangerous, as participants have to trust the organisation running the pool to not keep the rewards themselves. There is nothing built into the Bitcoin protocol to prevent a pool owner from pocketing the rewards, and such pools’ reputations are built only upon their owners’ history of good behaviour.

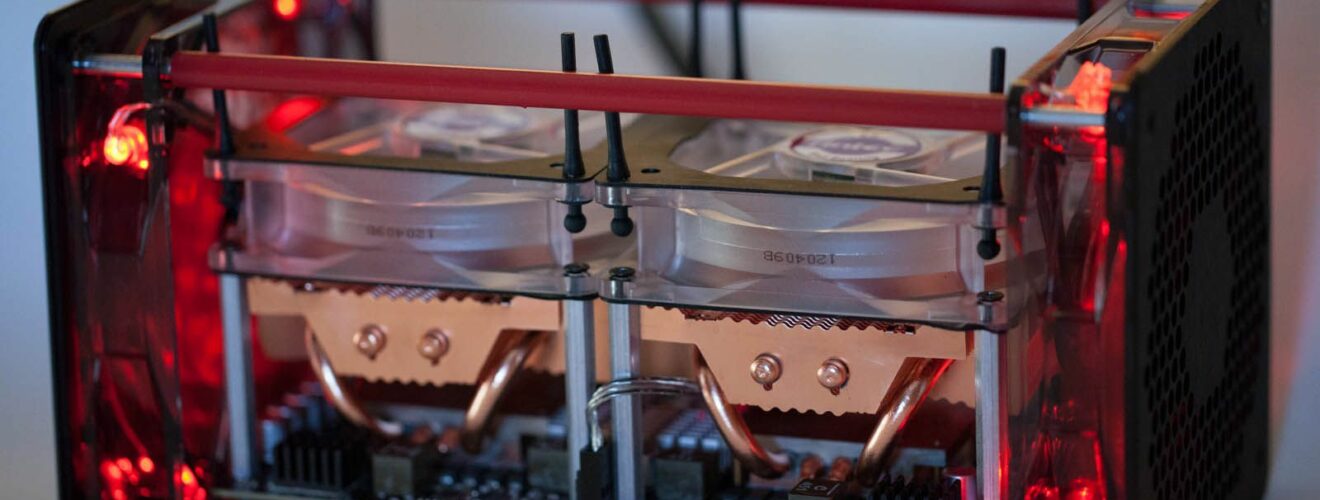

Mining hardware

There has been an arms race in recent months to produce hardware with higher and higher capacity to compute hashes in order to create proofs of work. Back in 2009, it was feasible to compute these hashes on a conventional CPU found in any laptop or desktop computer, but that is now a completely worthless pursuit, with the cost of electricity swamping the value of newly mined bitcoins. Mining for 24 hours a day for an entire week on a modern laptop CPU will produce less than a single penny’s worth of bitcoins yet consume around £1 of electricity. Even with access to free electricity, the rate at which Bitcoin mining is expanding would likely make it impossible to ever earn significant sums of money with typical CPUs. What’s more, being part of a mining pool means you must pay a transaction fee in the process of receiving your earnings, and this fee is often larger than 1p. In short, CPU mining is a complete waste of time and money.

After the initial CPU mining boom, the natural successor then became the use of graphics cards (GPUs), which specialise in computing many tasks in parallel—perfect for trying to find suitable hashes for proofs of work. However, even these have been superseded in recent times by special processors known as field programmable gate arrays (FPGAs), which can be programmed to perform only one task—computing proofs of work—by taking out the parts of a CPU that are unnecessary to mining. FPGAs are themselves now becoming less relevant, and recently the focus has been upon application-specific integrated circuits (ASICs, see article header image). These are devices that have been designed from scratch to mine bitcoins, and they are now leading the race. However, with such devices comes a price, and the fastest hardware costs many thousands of dollars. Although anyone can mine bitcoins, the miners making money are becoming more and more exclusive.

The darker side of Bitcoin

The anonymous nature of Bitcoin has its downsides. Bitcoin allows criminals to exchange money without the risks present with traditional currency, and users around the world can buy illegal drugs with seemingly little fear of being caught. A recent study in the US found that 18% of drug users had bought from the Silk Road website 4, a Bitcoin-friendly eBay-style drugs website run on top of the anonymising Tor network. Anonymity is not guaranteed with Bitcoin however, as the public nature of transactions means that anyone who has ever bought drugs from the website now has a paper trail. With each Bitcoin participant having a ledger of everyone else’s transaction history, these Silk Road users could face trouble in the future.

Additionally, websites have sprung up offering a method to pay for hitmen 5. High profile targets such as Barack Obama and the prime minister of Finland have topped the list, with anonymous users contributing bitcoins towards anyone willing to make the hit. The prize is given to the user that correctly predicts the date of assassination, so in theory someone planning a hit can simply predict the date they plan to do it and win the prize. Whether these websites are fake or not, they demonstrate the more malevolent aspects of the crypto-currency.

Some recent high-profile wallet thefts have also taken place. Dodgy wallet service operators can set up seemingly legitimate websites, accept users’ coins on their behalf, then close the site and steal the money. A Chinese operator called Global Bond Limited shut down unexpectedly in October 2013 6, with the owners’ silence over the matter leading to speculation that the closure was an intentional scam to steal the money. The best way to ensure your wallet remains secure is to use wallet software on your own computer, rather than trusting a third party.

Perhaps the most interesting darker side of Bitcoin is the identity of the founder. The original paper introducing the concept of Bitcoin 7 was written by someone called Satoshi Nakamoto. So far this person has not been identified, though recently a journalist writing for Newsweek claimed to have identified them as Dorian Nakamoto, a 64 year old Japanese-American man living in California 8. Dorian Nakamoto has to date never claimed to be the inventor of Bitcoin, and shortly after this incident the account used to post the original Bitcoin wallet software source code on the website P2P Foundation commented saying “I am not Dorian Nakamoto” 9.

Satoshi Nakamoto could be a pseudonym, and speculation has been rife as to the person’s real identity. The source code for the wallet software appears to have been written by someone of that name, but it is sufficiently large and complex that many commentators suggest that this person could in fact be several people 10. Why does the founder (or founders) feel the need to remain anonymous? Perhaps they believe they will be targeted by law enforcement agencies on occasions when Bitcoin is used for illegal activity. Perhaps they are sitting on millions of Bitcoins and have been selling them in small amounts for years, something which would surely irk the community and compromise the fairness of the system.

It’s arguably because of the anonymity of Bitcoin that it has had such success recently. Is the timing of the price spike and Edward Snowden’s NSA revelations a coincidence, or have peoples’ concerns over their online privacy reached a tipping point?

The future of Bitcoin

There have been few things on the web that have stood the test of time. Some behemoth companies have stuck around having been first to the party or having struck upon a unique idea hard to copy. However, as the demise of MySpace and the dot-com bubble bursting have proven, even the most widespread services can one day fail. Bitcoin might eventually become a widespread payment option, but competitors will be ready to jump on the next controversy it experiences.

The security principles that were built into Bitcoin are becoming less relevant now that average users are forced to take part in pools and encouraged to use wallets, requiring them to put their trust in people they’ve probably never met. The blockchain is becoming so large that eventually only expensive hardware will be capable of storing and operating with it. There is a possibility that companies will start offering these services on behalf of clients, in effect becoming banks—the very entity that Bitcoin tries to avoid having.

Are the general public ready to start using Bitcoin on a day to day basis? No. The market for Bitcoins is heavily speculative, and the value of bitcoins fluctuates by large amounts, minute by minute. It is better to think of bitcoins as shares on a volatile stock market and not as a gold standard. There are also unanswered questions as to whether profit made through bitcoin appreciation is taxable. These are clearly big issues, but a digital currency for the web makes sense. Globalisation demands efficiency, and currency conversion is not efficient. Just like the English language seems to have become the de-facto language of the web, helping to facilitate information exchange, so too can Bitcoin, or a crypto-currency like it, become the currency of the web. Can Bitcoin become this universal currency, though? There are still questions to be answered about the anonymous founder and if the currency is truly secure, but it’s certainly a fascinating concept. Clearly a lot of thought has gone into its design; its solutions to the pitfalls of crypto-currency are sometimes exquisite, and in some cases elegantly kill two birds with one stone.

To date, there has not been a full security audit of the Bitcoin protocol, and so questions hover over the security of the users of the system. It is worth bearing in mind that paper currency is not without its problems either. Bitcoin isn’t perfect, but it’s an impressively well-thought through protocol. The last 5 years has been an explosive ride for the crypto-currency. If it’s still the ubiquitous web currency 5 years from now, then it may well be around for a long time to come.

References

- https://blockchain.info/charts/market-cap

- https://blockchain.info/charts/total-bitcoins

- http://rt.com/business/bitcoin-russia-use-ban-942/

- http://dx.doi.org/10.1111/add.12470

- http://rt.com/news/bitcoin-assassination-market-anarchist-983/

- http://www.techienews.co.uk/972880/bitcoin-trading-platform-gbl-shuts-5-million-bitcoin-disappears/

- http://bitcoin.org/bitcoin.pdf

- http://www.slate.com/blogs/future_tense/2014/03/06/the_real_satoshi_nakamoto_newsweek_finds_mysterious_bitcoin_creator_in_los.html

- http://p2pfoundation.ning.com/forum/topics/bitcoin-open-source?commentId=2003008%3AComment%3A52186

- http://www.ibtimes.co.uk/bitcoin-creator-satoshi-nakamoto-value-digital-currency-530480

Easy to check out, easy to read…heck I had developed to leave a commment!